26 October 2023 Attila Kálmán

Attila Kálmán Amund Trellevik

Amund Trellevik

Green transition, dirty business: Europe’s struggle to tear loose from Chinese minerals

Shutterstock

Green transition, dirty business: Europe’s struggle to tear loose from Chinese minerals

26 October 2023A global rush for minerals is underway. Europe wants to revive its mining industry to secure the lithium, nickel, copper and rare earth elements needed for a green future. Investigate Europe sieves fact from fiction in the hunt for critical raw materials.

"This has been 130 years of encroachment on our nature and abuse of us Sámi in this area," says Karin Kvarfordt Niia.

The ground is slowly caving in around Kiruna in northern Sweden, where Europe’s largest iron ore mine has operated since the late 19th century. Excessive excavation has left Kiruna buckling under the strain of its mineral riches. There are fears that part of the town, with around 20,000 people, will literally sink into the ground. To avoid this, authorities are moving the whole city centre to new land, a mega operation paid for by the state-owned mining company LKAB.

Kiruna was built on indigenous Sámi land. Now the mining company, together with the Swedish government, has announced plans to establish another mineshaft to access a huge find of rare earth elements, and more iron ore. The government sees prosperity and development. For many in the Sámi community, the radical plans mean further erosion of their way of life.

“They have dried up lakes where we used to fish. They have taken away from us areas where our reindeer have grazed forever. We have had to move from our villages,” says Niia, a local Sámi spokesperson.

What coal was to the 19th century, and oil to the 20th, rare earth elements are to the 21st. Other metals are suddenly also becoming crucial, such as lithium, cobalt and nickel. These commodities are essential for the green transition, and for strategic sectors such as defence and space. They are also crucial components for smartphones, televisions, and laptops.

Without sufficient supply of these metals the planned "climate neutrality" will remain a pipe dream, because so far this shall be achieved predominantly by a pure technological switch to wind and solar power or electric vehicles. This needs vast amounts of these metals, far beyond the current supply.

The ground is slowly caving in around Kiruna in northern Sweden, where Europe’s largest iron ore mine has operated since the late 19th century. Excessive excavation has left Kiruna buckling under the strain of its mineral riches. There are fears that part of the town, with around 20,000 people, will literally sink into the ground. To avoid this, authorities are moving the whole city centre to new land, a mega operation paid for by the state-owned mining company LKAB.

Kiruna was built on indigenous Sámi land. Now the mining company, together with the Swedish government, has announced plans to establish another mineshaft to access a huge find of rare earth elements, and more iron ore. The government sees prosperity and development. For many in the Sámi community, the radical plans mean further erosion of their way of life.

“They have dried up lakes where we used to fish. They have taken away from us areas where our reindeer have grazed forever. We have had to move from our villages,” says Niia, a local Sámi spokesperson.

What coal was to the 19th century, and oil to the 20th, rare earth elements are to the 21st. Other metals are suddenly also becoming crucial, such as lithium, cobalt and nickel. These commodities are essential for the green transition, and for strategic sectors such as defence and space. They are also crucial components for smartphones, televisions, and laptops.

Without sufficient supply of these metals the planned "climate neutrality" will remain a pipe dream, because so far this shall be achieved predominantly by a pure technological switch to wind and solar power or electric vehicles. This needs vast amounts of these metals, far beyond the current supply.

Karin Kvarfordt Niia says more mining around Kiruna poses further threats to the Sámi way of life. Credit: Lars-Ola Marakatt

Europe's largest depost of rare earths was recently discovered in Kiruna, where a vast iron ore project overlooks the town. Credit: Lars-Ola Marakatt

The EU is a major consumer of rare earth elements and other critical raw minerals, but is dependent on others to obtain them. Ten countries dominate the mining of critical raw materials, notably China, Russia, Chile and Democratic Republic of Congo. While the EU banned Russian oil and coal following the Ukraine invasion, imports of critical raw materials persist. Investigate Europe previously revealed how the EU purchased €13.7 billion worth of critical raw materials from Russia following the invasion of Ukraine to July 2023.

But it is the dependency on China that burns brightest. Europe relies on this single supplier for more than 90 per cent of rare earth elements, gallium and magnesium, and China controls more than half the global capacity for the processing of lithium, cobalt and manganese.

“Our main concern is excessive dependencies, meaning dependency on a single source of supply,” Thierry Breton, EU Commissioner for the internal market, tells Investigate Europe. “When we have such dependencies and Russia is at war, or China bans exports, or there is an earthquake in Chile, we can have a problem.”

But it is the dependency on China that burns brightest. Europe relies on this single supplier for more than 90 per cent of rare earth elements, gallium and magnesium, and China controls more than half the global capacity for the processing of lithium, cobalt and manganese.

“Our main concern is excessive dependencies, meaning dependency on a single source of supply,” Thierry Breton, EU Commissioner for the internal market, tells Investigate Europe. “When we have such dependencies and Russia is at war, or China bans exports, or there is an earthquake in Chile, we can have a problem.”

Europe now wants to bring its supply in-house, freer from Chinese influence. New mining projects are in the works across the continent for the first time in decades. A related law is set to be rubber stamped and ‘green mining’ has become a buzzword around Brussels.

In January, Sweden’s state-owned LKAB announced that they had found a large deposit of rare earth minerals in Kiruna in Lapland. The find coincided with Sweden's presidency of the Council of the EU. During a visit to the city, energy minister Ebba Busch hailed the discovery as a key to the green transition, not just for Sweden but for Europe.

Today, most CRMs are only mined in microscopic quantities in Europe, while ore processing and refining have almost completely disappeared. Europe imports 100 per cent of a variety of important metals.

In January, Sweden’s state-owned LKAB announced that they had found a large deposit of rare earth minerals in Kiruna in Lapland. The find coincided with Sweden's presidency of the Council of the EU. During a visit to the city, energy minister Ebba Busch hailed the discovery as a key to the green transition, not just for Sweden but for Europe.

Today, most CRMs are only mined in microscopic quantities in Europe, while ore processing and refining have almost completely disappeared. Europe imports 100 per cent of a variety of important metals.

The Xinjiang Rare Metals National Mine Park in China.Shutterstock

"At this very moment, if we would produce rare earths in the EU, they would have to go through China (or at least Asia) for some transformation steps into a magnet," says Stephane Bourg of the French Geological Survey. “There is zero plants in the EU transforming rare earth oxide into rare earth metal, which is a very crucial step, even if such projects are in the pipe. If I today dump 10,000 tonnes of neodymium oxide in your garden, you won’t know what to do with it."

Neodymium is a rare earth metal that is not only highly magnetic, but remains so at higher temperatures. Three other rare earths (terbium, dysprosium and holmium) are even better at this. These materials have two things in common: they are needed for modern weapons as well as electric cars, and China controls the market. "We are 100 per cent dependent on China," Thomas Schmall, a Volkswagen executive, recently told the Wall Street Journal.

The Critical Raw Materials Act (CRMA), which could become one of the fastest EU laws ever adopted, aims to reverse this dependency. The Commission presented its proposal on 16 March, and it could be adopted by the end of 2023. Under the plans, which most member states support, there are no national obligatory targets. However, the EU Commission wants the following to come from Europe by 2030:

Neodymium is a rare earth metal that is not only highly magnetic, but remains so at higher temperatures. Three other rare earths (terbium, dysprosium and holmium) are even better at this. These materials have two things in common: they are needed for modern weapons as well as electric cars, and China controls the market. "We are 100 per cent dependent on China," Thomas Schmall, a Volkswagen executive, recently told the Wall Street Journal.

The Critical Raw Materials Act (CRMA), which could become one of the fastest EU laws ever adopted, aims to reverse this dependency. The Commission presented its proposal on 16 March, and it could be adopted by the end of 2023. Under the plans, which most member states support, there are no national obligatory targets. However, the EU Commission wants the following to come from Europe by 2030:

- at least 10 per cent of the EU's annual consumption for extraction;

- at least 40 per cent of the EU's annual consumption for processing;

- at least 15 per cent of the EU's annual consumption for recycling;

- no more than 65 per cent of the EU's annual consumption should come from a single third country

Back in 2011, the EU Commission created a list of critical raw materials. It included 14 materials or groups of materials. This year's list includes 34, a sign of their growing economic, strategic and climate importance to the continent. "We need to prove that the Green Deal is not made in China," says Rolf Kuby, director general of the mining lobby Euromines.

At a meeting in Brussels this June, member states proposed commodities for inclusion on the 2023 critical raw materials list. Sixteen of these have recently also been labelled ‘strategic’, meaning related projects would be prioritised for EU funding. The critical raw materials list is based on an analysis by the Joint Research Centre, an EU institute. But this is not just science: “It's a political decision where to draw the line", explains a source who previously worked on the CRMA plans and requested anonymity.

Nickel and copper did not reach the threshold to be declared critical, but were nevertheless included following political pressure. Bauxite was also added after member state lobbying. Poland, meanwhile, a major coal producer, succeeded in adding coking coal to a list which officials argue is essential for the green transition.

At a meeting in Brussels this June, member states proposed commodities for inclusion on the 2023 critical raw materials list. Sixteen of these have recently also been labelled ‘strategic’, meaning related projects would be prioritised for EU funding. The critical raw materials list is based on an analysis by the Joint Research Centre, an EU institute. But this is not just science: “It's a political decision where to draw the line", explains a source who previously worked on the CRMA plans and requested anonymity.

Nickel and copper did not reach the threshold to be declared critical, but were nevertheless included following political pressure. Bauxite was also added after member state lobbying. Poland, meanwhile, a major coal producer, succeeded in adding coking coal to a list which officials argue is essential for the green transition.

Neodymium is a rare earth metal essential for modern weapons and electric cars. Credit: Shutterstock

Europe relies on China for more than 90 per cent of rare earth elements. Credit: Shutterstock

Industry has had "enormous influence" on the framing of CRMA, according to campaign group Friends of the Earth. Mining companies, associated metals and minerals companies and their lobby groups have spent more than €21 million a year lobbying and racked up nearly 1,000 meetings with EU decision-makers since 2014.

The CRMA proposal, currently being debated in Brussels, follows the industry’s wish list: faster processing of permits, self-regulation, and “strategic” projects harmful to the environment to be allowed if they are of “overriding public interest”. "CRMA in its current form is a clear example of corporate capture,” Friends of the Earth concludes.

Henrike Hahn, a German MEP, confirms industry’s strong interest. "The industry expects this law as soon as possible,” she says. “But also politicians put a lot of pressure because they want to present some successes.”

The Sámi struggle in Sweden echoes the resistance to mining that is coming to the surface across Europe: when Europe is to depend less on China, that means more industry on European soil.

The CRMA proposal, currently being debated in Brussels, follows the industry’s wish list: faster processing of permits, self-regulation, and “strategic” projects harmful to the environment to be allowed if they are of “overriding public interest”. "CRMA in its current form is a clear example of corporate capture,” Friends of the Earth concludes.

Henrike Hahn, a German MEP, confirms industry’s strong interest. "The industry expects this law as soon as possible,” she says. “But also politicians put a lot of pressure because they want to present some successes.”

The Sámi struggle in Sweden echoes the resistance to mining that is coming to the surface across Europe: when Europe is to depend less on China, that means more industry on European soil.

“Some things are priceless. There are things that are not renewable, they never come back.”

— Carla Gomes, Portuguese activist

In Kassandra, northern Greece, ElDorado Gold has fenced off an entire mountain, where it plans to open a surface and underground copper mine. The Canadian firm’s wholly owned subsidiary, Hellas Gold, has been repeatedly found in violation of environmental regulations (company response). Local activists are fearful of potential dam failures, due to extreme weather events, and possible harm to water quality for residents.

“We have put in place an extensive monitoring system to make sure our operations don’t affect water quality” Emmy Gazea, the company’s environmental manager assures Investigate Europe.

Two lithium mining projects in the northeast region of Trás os Montes in Portugal, have sparked huge debate about industry in untouched nature. The region was recently recognised by the UN as a “globally important agricultural heritage system”. It is one of only eight such areas in Europe, and the only one in Portugal.

The government says a “very limited” part of this territory will be affected, but Carla Gomes is not convinced. Born in a small village near one of the mining sites, she is now organising an anti-mine movement that has attracted protesters from several countries.

“Some things are priceless,” she says. “There are things that are not renewable, they never come back. Once that region, those mountains, were turned into mines, they would never be mountains again and nothing would ever be the same again.”

“We have put in place an extensive monitoring system to make sure our operations don’t affect water quality” Emmy Gazea, the company’s environmental manager assures Investigate Europe.

Two lithium mining projects in the northeast region of Trás os Montes in Portugal, have sparked huge debate about industry in untouched nature. The region was recently recognised by the UN as a “globally important agricultural heritage system”. It is one of only eight such areas in Europe, and the only one in Portugal.

The government says a “very limited” part of this territory will be affected, but Carla Gomes is not convinced. Born in a small village near one of the mining sites, she is now organising an anti-mine movement that has attracted protesters from several countries.

“Some things are priceless,” she says. “There are things that are not renewable, they never come back. Once that region, those mountains, were turned into mines, they would never be mountains again and nothing would ever be the same again.”

Carla Gomes is part of an anti-mine movement against a planned lithium mine in northern Portugal. Credit Investigate Europe

Residents fear the Barroso site will damage surrounding areas of protected countryside. Credit: Vítor Martinho/Tiago Carrasco

However, without such mined materials - essential components for electronics - the modern comforts of daily life would not be possible. “The people are hypocrites,” shouts Peter Tzeferis, a senior mining official in Greece’s ministry of environment and energy, as he waves a colleague’s phone in the air. "They want a phone - and a cheap one at that! - but refuse to even consider what minerals are needed and where they come from. I’ve been repeating this for decades, now I've given up. I think people don't want to know.”

Trying to reduce the demand for minerals and avoiding new mining altogether is not high on the EU agenda. In the EU Commission's 200-page impact assessment published alongside the CRMA proposal, this basic question is directed to a box in the last annex.

Instead, industrial assessments prevail. And the scale of this hunger is staggering: in the next 30 years, mankind will have to mine more than it has in the last 70,000 years. “We, eight billion of us, will use more metal than the 108 billion people who lived before us,” French journalist Guillaume Pitrón wrote in his book Rare Metal Wars.

Trying to reduce the demand for minerals and avoiding new mining altogether is not high on the EU agenda. In the EU Commission's 200-page impact assessment published alongside the CRMA proposal, this basic question is directed to a box in the last annex.

Instead, industrial assessments prevail. And the scale of this hunger is staggering: in the next 30 years, mankind will have to mine more than it has in the last 70,000 years. “We, eight billion of us, will use more metal than the 108 billion people who lived before us,” French journalist Guillaume Pitrón wrote in his book Rare Metal Wars.

“The people are hypocrites, they want a cheap phone... but refuse to even consider what minerals are needed. ”

— Peter Tzeferis, Greek mining official

One widely quoted study estimates that by 2050, Europe will use 21 times more lithium, four times more cobalt (an important raw material for batteries) and four times more dysprosium (a rare earth element used in magnets for electric motors). The study was funded by the metals lobby Eurometaux.

Liesbet Gregoir, the study’s author, says that she based her calculations on data from the International Energy Agency (IEA). "The world needs to invest in new mining. In the short term, if you want to build those electric vehicles or those windmills, there is no scrap to recycle. So we need to mine that material,” Gregoir says. The study predicted that the transportation sector will drive 60 per cent of the increased demand, in part as the EU will ban sales of new petrol and diesel cars from 2035.

A 2021 report by the IEA predicted that total mineral demand globally will increase by a multiple of between two and four times between 2020 and 2040, and demand for battery-related materials such as lithium up to 42 times.

Liesbet Gregoir, the study’s author, says that she based her calculations on data from the International Energy Agency (IEA). "The world needs to invest in new mining. In the short term, if you want to build those electric vehicles or those windmills, there is no scrap to recycle. So we need to mine that material,” Gregoir says. The study predicted that the transportation sector will drive 60 per cent of the increased demand, in part as the EU will ban sales of new petrol and diesel cars from 2035.

A 2021 report by the IEA predicted that total mineral demand globally will increase by a multiple of between two and four times between 2020 and 2040, and demand for battery-related materials such as lithium up to 42 times.

The projections from the IEA and other studies, including from the EU and World Bank, “make many faulty assumptions about future raw material needs”, says Diego Marin, a policy officer at the European Environmental Bureau.

He believes the studies do not differentiate between what is needed and what is wasteful consumption. “These projections also heavily rely on growth of private vehicle use and create a car dependent self-fulfilling prophecy, which supports the car industry narrative.”

No wonder that even Euromines could not say when asked by Investigate Europe how much money and how many new mines would be needed, given the varying projections. "It's impossible to give a figure," says Rolf Kuby, arguing that there are many factors, from technological development to energy prices and industrial processes, that are impossible to model.

He believes the studies do not differentiate between what is needed and what is wasteful consumption. “These projections also heavily rely on growth of private vehicle use and create a car dependent self-fulfilling prophecy, which supports the car industry narrative.”

No wonder that even Euromines could not say when asked by Investigate Europe how much money and how many new mines would be needed, given the varying projections. "It's impossible to give a figure," says Rolf Kuby, arguing that there are many factors, from technological development to energy prices and industrial processes, that are impossible to model.

There are approximately 100 metals mines operating in Europe today, of which between 40 and 50 mine critical raw materials, according to the IEA. Euromines’ Kuby wants to see another hundred open in the next decade. Alongside Sweden, Greece and Portugal, there are plans at least in France, Norway, Spain, and Finland to open critical raw material mines. Most EU states have potential deposits, according to Euromines.

The true scale of Europe’s mineral resources is unknown because few geological surveys have been made in the last 40 years, in part because Europe abandoned extractive sectors within its borders.

“China is constantly exploring for new deposits, unlike us in Europe that have stopped systematic mineral exploration,” says Alecos Demetriades, a retired mining and exploration geologist at the Hellenic Geological Survey in Athens.

Exploration is only the first step, however. Approving a mine is a lengthy process, and permits take many years to get. It is no coincidence that many are lobbying for the CRMA to significantly shorten this process. Advocates argue that this would not be irresponsible and would not pose a greater threat to the environment, while critics argue that it would

The true scale of Europe’s mineral resources is unknown because few geological surveys have been made in the last 40 years, in part because Europe abandoned extractive sectors within its borders.

“China is constantly exploring for new deposits, unlike us in Europe that have stopped systematic mineral exploration,” says Alecos Demetriades, a retired mining and exploration geologist at the Hellenic Geological Survey in Athens.

Exploration is only the first step, however. Approving a mine is a lengthy process, and permits take many years to get. It is no coincidence that many are lobbying for the CRMA to significantly shorten this process. Advocates argue that this would not be irresponsible and would not pose a greater threat to the environment, while critics argue that it would

A copper mine in Andalusia, Spain. It is one of between 40 and 50 CRM mines on the continent.Shutterstock

In any case, few banks would take the risk to lend money for mining. Establishing a mine could cost in the region of €1 billion, according to Euromines. "No strategy will come to life without investments," says Margrethe Vestager, the EU Commissioner in charge of competition. “The money should not come through the Commission, which is a huge bureaucracy, not a bank."

The Commission did not earmark a separate fund for the CRMA, although there were attempts to do so. At the same time, the US government is providing several hundred billion dollars to support the green transition there. These subsidies also tempt European companies, not least in the battery business, to choose the US rather than Europe.

The Commission suggested member states could use existing budgets to pay for their new mining endeavors. Germany has already set aside €1 billion, and Sweden and France are also leading the way. But less wealthy nations are likely to be left behind. "We cannot rely on state aid to develop Europe, because otherwise Europe will not develop in two speeds, but many different speeds," Vestager adds.

Although the Commission supports new mines, there is no specific EU funding, nor is any forthcoming from the European Investment Bank. There seem to be two ways to boost European mining: through state aid to develop a European mining industry, or by supporting the expansion of existing mining companies. But only 8 per cent of the world’s 200 biggest mining companies in terms of capitalisation, are European.

The Commission did not earmark a separate fund for the CRMA, although there were attempts to do so. At the same time, the US government is providing several hundred billion dollars to support the green transition there. These subsidies also tempt European companies, not least in the battery business, to choose the US rather than Europe.

The Commission suggested member states could use existing budgets to pay for their new mining endeavors. Germany has already set aside €1 billion, and Sweden and France are also leading the way. But less wealthy nations are likely to be left behind. "We cannot rely on state aid to develop Europe, because otherwise Europe will not develop in two speeds, but many different speeds," Vestager adds.

Although the Commission supports new mines, there is no specific EU funding, nor is any forthcoming from the European Investment Bank. There seem to be two ways to boost European mining: through state aid to develop a European mining industry, or by supporting the expansion of existing mining companies. But only 8 per cent of the world’s 200 biggest mining companies in terms of capitalisation, are European.

“China is constantly exploring for new deposits, unlike us in Europe that have stopped systematic mineral exploration.”

— Alecos Demetriades, retired geologist

Even if there was a bottomless pit of money for projects, the EU's problems would not end. For one thing, mining is a long process, and by the time the raw materials start to be extracted, even new technologies could displace the old ones. Secondly, raw materials are needed now for the green transition, and for the defence and space industries.

Chinese authorities do not care about quarterly business results. They think long-term. Back in 1987, when the US still dominated mining and these metals were of much less importance globally, the then ruler Deng Xiaoping, said: “The Middle East has oil, China has rare earths.” This famous phrase was uttered in Baotau, where more than half of the world's rare earth mining now takes place. A few years ago the proportion was higher, but mining is not the real issue.

"China controls the materials in the refining and metallic level. They don't care who mines the stuff,” explains James Kennedy, an American mine owner who consults the US government on the issue of rare earths. “In fact, they'd prefer you mine it and you pollute your country and you diminish your resources. They build the refining and they make the refining so inexpensive no one else can compete.”

The state-subsidised mining, refining and metals industries in China are not run on a profit principle, in the interests of shareholders, but for geopolitical gain. If it controls raw materials, China can control a number of strategic industries and thus its competitors. As the EU sees it, China has become a "systemic rival".

Investigate Europe contacted the permanent mission of China to the EU in Brussels with questions, but has received no response.

Chinese authorities do not care about quarterly business results. They think long-term. Back in 1987, when the US still dominated mining and these metals were of much less importance globally, the then ruler Deng Xiaoping, said: “The Middle East has oil, China has rare earths.” This famous phrase was uttered in Baotau, where more than half of the world's rare earth mining now takes place. A few years ago the proportion was higher, but mining is not the real issue.

"China controls the materials in the refining and metallic level. They don't care who mines the stuff,” explains James Kennedy, an American mine owner who consults the US government on the issue of rare earths. “In fact, they'd prefer you mine it and you pollute your country and you diminish your resources. They build the refining and they make the refining so inexpensive no one else can compete.”

The state-subsidised mining, refining and metals industries in China are not run on a profit principle, in the interests of shareholders, but for geopolitical gain. If it controls raw materials, China can control a number of strategic industries and thus its competitors. As the EU sees it, China has become a "systemic rival".

Investigate Europe contacted the permanent mission of China to the EU in Brussels with questions, but has received no response.

Rare earth metals are not rare in the earth's crust at all, in fact they are essentially everywhere. However, the question is how much. They are called rare because there are usually only a few grams of them in a few tonnes.

That is why it was headline news when the Swedes announced in January that they had found a large deposit of rare earths in Kiruna.

To get to the rare metals, you need to move tonnes and tonnes of stone. It takes hundreds or even thousands of tonnes of rock to extract one kilogram of rare earth metals. These rocks are crushed, soaked in acids and, at the end of a refining process, the metal remains. Plus many, many tonnes of rock that is considered hazardous waste, which also could contain radioactive elements.

Not only mining, but also this refining process, have been vociferously opposed by environmental movements in the US and Europe, due to extensive pollution and health concerns. Instead of spending money on solutions, companies took their business to the eager Chinese. Let the Chinese mine, do the dirty work, and the West will step in at the high value-added end of the supply chain. That was the idea.

The results are widely known, from the children working in the cobalt mines of the Congo, to the water shortages in Chile, to the brutal destruction of nature in China. For the Western world, this was fine for a long time: profits increased, consumers got the gadgets they wanted and pollution was out of sight.

China for its part has followed a long-term, well thought-out strategy, with calculated environmental costs. Over the decades, it has moved up the value chain, building its own defence, high-tech and automotive industries. This year, Chinese car exports overtook German exports.

That is why it was headline news when the Swedes announced in January that they had found a large deposit of rare earths in Kiruna.

To get to the rare metals, you need to move tonnes and tonnes of stone. It takes hundreds or even thousands of tonnes of rock to extract one kilogram of rare earth metals. These rocks are crushed, soaked in acids and, at the end of a refining process, the metal remains. Plus many, many tonnes of rock that is considered hazardous waste, which also could contain radioactive elements.

Not only mining, but also this refining process, have been vociferously opposed by environmental movements in the US and Europe, due to extensive pollution and health concerns. Instead of spending money on solutions, companies took their business to the eager Chinese. Let the Chinese mine, do the dirty work, and the West will step in at the high value-added end of the supply chain. That was the idea.

The results are widely known, from the children working in the cobalt mines of the Congo, to the water shortages in Chile, to the brutal destruction of nature in China. For the Western world, this was fine for a long time: profits increased, consumers got the gadgets they wanted and pollution was out of sight.

China for its part has followed a long-term, well thought-out strategy, with calculated environmental costs. Over the decades, it has moved up the value chain, building its own defence, high-tech and automotive industries. This year, Chinese car exports overtook German exports.

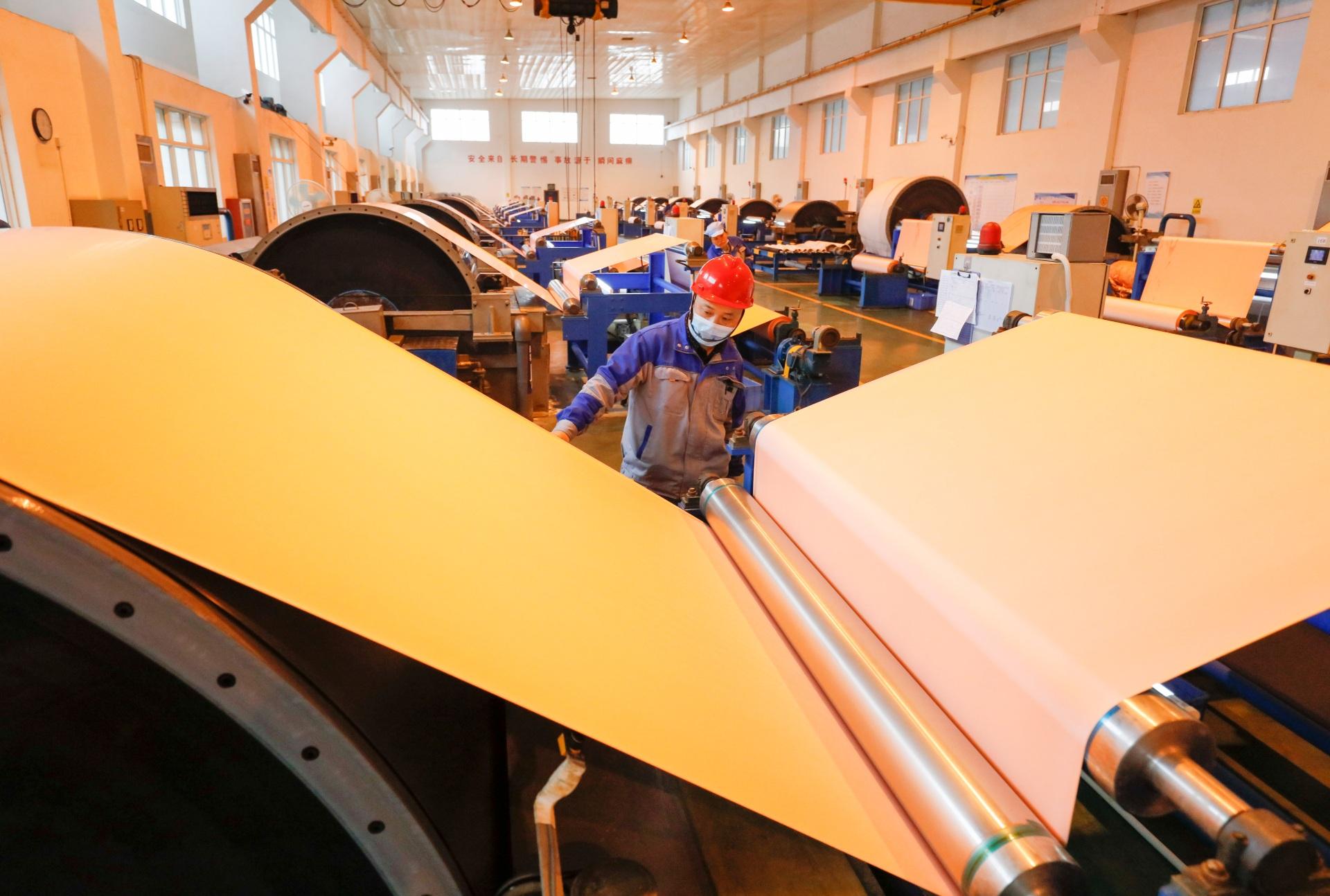

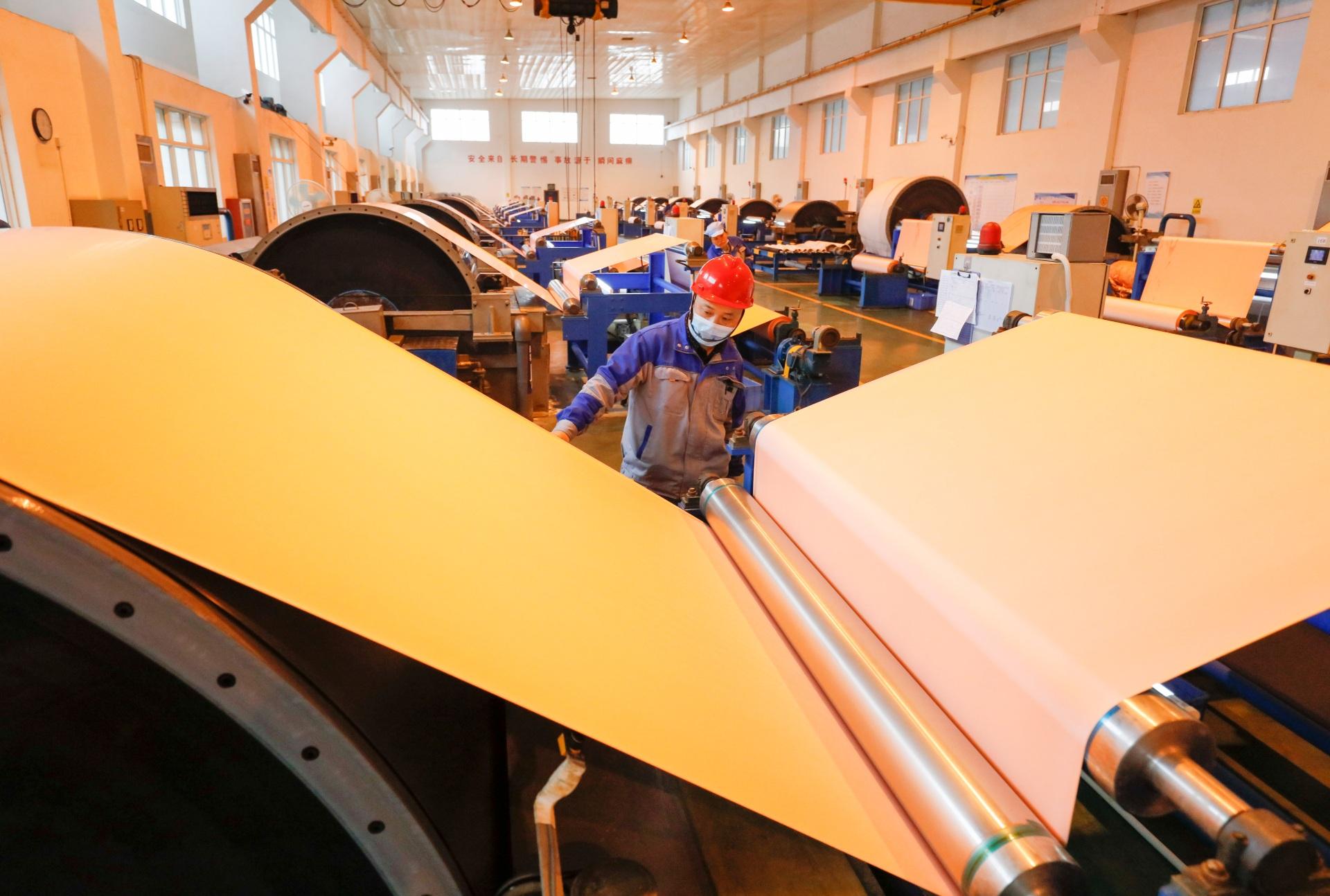

China now has stakes in the entire value chain of critical raw materials from mining to end production. Credit: Shutterstock

Workers in Jiangxi Provence make electronic goods for international export. Credit: Shutterstock

The EU Commission is working to meet the needs of European industry. But opening masses of new mines in Europe seems unlikely. So Brussels is looking elsewhere.

In June, EU Commission president Ursula von der Leyen visited Brazil, Argentina, Chile and Mexico. She met political officials and also spoke with business leaders and stakeholders. She announced that the EU would invest €10 billion in 108 green projects in Latin America and the Caribbean.

The European Commission president signed a Memorandum of Understanding on Raw Materials with Argentina, and an agreement with Chile. The Commission has already signed strategic partnerships with Canada, Ukraine, Kazakhstan and Namibia, and is negotiating with eight others, including Democratic Republic of Congo and Australia.

In June, EU Commission president Ursula von der Leyen visited Brazil, Argentina, Chile and Mexico. She met political officials and also spoke with business leaders and stakeholders. She announced that the EU would invest €10 billion in 108 green projects in Latin America and the Caribbean.

The European Commission president signed a Memorandum of Understanding on Raw Materials with Argentina, and an agreement with Chile. The Commission has already signed strategic partnerships with Canada, Ukraine, Kazakhstan and Namibia, and is negotiating with eight others, including Democratic Republic of Congo and Australia.

Lithium fields in the Atacama desert. The EU recently signed an agreement with Chile on critical raw materials.Shutterstock

An EU diplomat admitted that these partnerships are their solution for the moment, and added that the EU requires the same standards from their partners as in the EU and supports “an environmentally respectful manner” of mining. How the EU intends to ensure such standards on the ground, however, remains to be seen.

Mining and refining are nevertheless still polluting activities, meaning that the EU's strategy of dependence has not changed much in the past 30 years: the default position is still to maintain the welfare of European consumers by exporting environmental damage to the global South.

And so, while Europe might not be set for its own mining renaissance anytime soon, some projects are indeed coming to the global North.

The controversial development in Kiruna exemplifies the EU’s ambitious plans. It is also a stark reminder of the dirty business that lies behind the quest for climate neutrality. As Håkan Jonsson, president of the Swedish Sámi Parliament, aptly says: "For us, the green transition becomes a black transition."

Editors: Chris Matthews & Ingeborg Eliassen

Graphics: Marta Portocarrero

This investigation is supported by Journalismfund Europe’s Investigation Grants for Environmental Journalism.

Mining and refining are nevertheless still polluting activities, meaning that the EU's strategy of dependence has not changed much in the past 30 years: the default position is still to maintain the welfare of European consumers by exporting environmental damage to the global South.

And so, while Europe might not be set for its own mining renaissance anytime soon, some projects are indeed coming to the global North.

The controversial development in Kiruna exemplifies the EU’s ambitious plans. It is also a stark reminder of the dirty business that lies behind the quest for climate neutrality. As Håkan Jonsson, president of the Swedish Sámi Parliament, aptly says: "For us, the green transition becomes a black transition."

Editors: Chris Matthews & Ingeborg Eliassen

Graphics: Marta Portocarrero

This investigation is supported by Journalismfund Europe’s Investigation Grants for Environmental Journalism.